The increased minimum wage causes not only the increase of employees’ net incomes, but also the increase of levies and hourly rates. To show the level, at which the new sum of the minimum wage will be reflected in the costs of employers from among SMEs, we have performed several calculations and comparisons (some of them in cooperation with the Slovak Ministry of Labour).

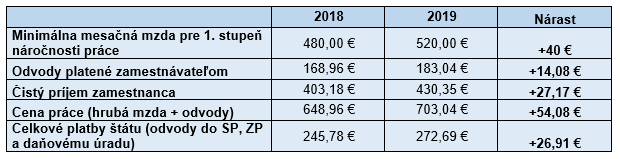

The sum of the minimum wage in 2018 as compared to 2019

On the next figure, you can see a comparison of net incomes of an employee, levies paid by the employer, hourly rates, and total payments to the state budget in 2018 and in 2019. When comparing hourly rates and net incomes of the employee, we can see that the sum on the employee’s payroll slip will be of EUR 27.17 higher (if the deductible allowance for health insurance is applied), but the costs of the employer caused by the increased minimum wage is EUR 54.08 (the difference between the original and new minimum wages + levies).

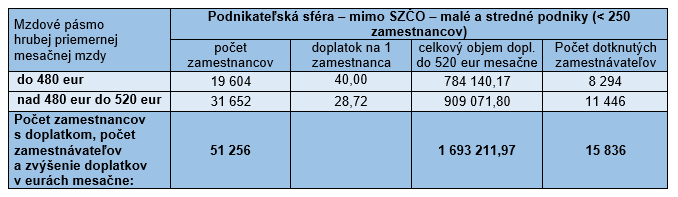

When calculating the overall impact of the increased minimum wage on the business sector, the Slovak Ministry of Labour took the sum of EUR 520 as a basis too. Based on this assumption, the Slovak Ministry of Labour calculated that the increase of the minimum wage up to EUR 520 would, in total, relate to 28,792 employers – natural persons and 15,836 employers – legal persons classified as micro, small, and medium-sized enterprises. More information regarding the method of calculation of the number of affected SMEs could be found in our SME Test or in the Analysis of Impacts on the Business Sector prepared by the Slovak Ministry of Labour.

1. Additional payments to cover the new minimum wage

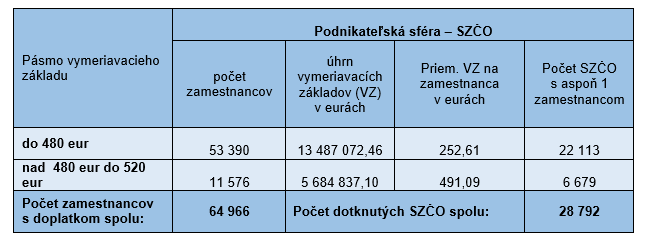

As for the employees of self-employed persons, it is not possible to reflect the number of worked hours and the agreed weekly working hours upon the data regarding the bases of assessment obtained from the Social Insurance Company, so some assumptions were used for performing a qualified estimation. As for the group of employees, for whom the range of the bases of assessment is lower than EUR 480, i.e. than the currently applicable gross minimum monthly wage, the average basis of assessment per employee is EUR 252.61. At the increase of the minimum wage up to EUR 520, i.e. by 8.33%, it can be assumed that the average basis of assessment at this group of employees will increase by the same value. Therefore, the total sum of additional monthly payments for 53,390 employees in this category represents:

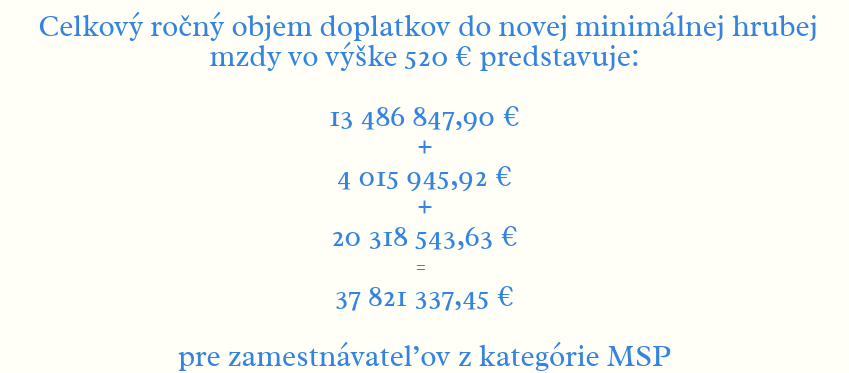

252.61 * [(520-480)/480] * 53,390 = EUR 1,123,903.99 per month, i.e. EUR 13,486,847.90 per year.

As for the second group of employees of self-employed persons, i.e. those, for whom the range of the bases of assessment oscillated between EUR 480 and EUR 520, additional monthly payments to cover the wage represent the difference between the new minimum wage and the current average basis of assessment, i.e.:

(520-491.09) * 11,576 employees = EUR 334,662.16, i.e. EUR 4,015,945.92 a year.

As for the employers – legal persons from the category of micro, small, and medium-sized enterprises, the total sum of additional monthly payments to cover the minimum wage represents EUR 1,693,211.97, i.e. EUR 20,318,534.63 a year.

2. Health insurance levies from the higher minimum wage

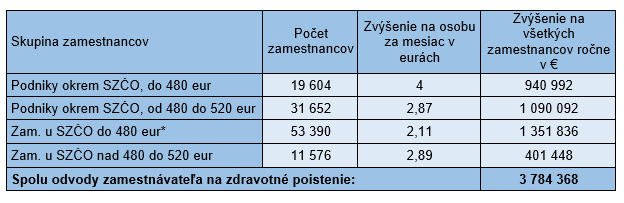

The increased minimum wage will also affect the sum of health insurance levies to be paid by employers for their employees. The total increase of the sum of health insurance levies paid by SMEs (as a result of the increased minimum wage to EUR 520) represents EUR 3,784,368.

Total impact of the increased minimum wage

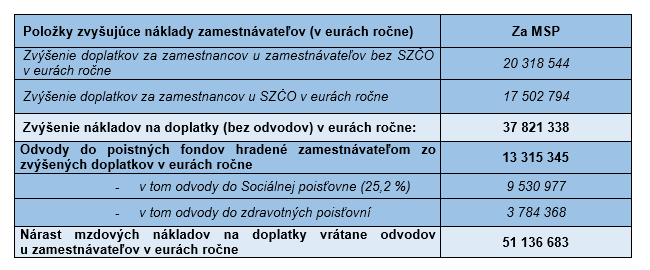

The estimated increase of personnel costs for employers from the category of SMEs is more than EUR 51 million. This sum includes additional payments to cover the new minimum wage (increase of the minimum wage to EUR 520) in the sum of EUR 37.8 million, health insurance levies paid by employers in the sum of EUR 3.7 million, and levies to the Social Insurance Company (25.2% of gross wages) in the sum of EUR 9.5 million.

However, it should be emphasized that this sum does not include increased personnel costs for the employees who do not receive the basic minimum wage, indeed, but their work performance is appreciated in accordance with higher levels of work difficulty in compliance with wage requirements. If this group of employees is taken into account in calculations, the increased personnel costs for employers – SMEs would be even more significantly higher.